Cyber security 101: How can Aussies stay safe online?

The COVID-19 pandemic has forced Aussie customers to shop, bank, work and even study online at record speeds. After months and months of lockdown, our online habits haven’t changed much since the outbreak.

A record number of Aussie customers are still shopping online. The problem is that not everyone gets what they pay for, as the rate of fraud and phishing attacks is also on the rise.

We have seen an increase in the use of VPNs in Australia as Australian netizens are aware of the importance of cyber security.

How can Aussie consumers protect themselves when browsing the internet? There is no one-size-fits-all solution for cybersecurity. There are several ways consumers can ensure a safer browsing experience and a secure connection when shopping online.

Here are the best cyber security tips from Australian cyber security experts.

Use a VPN service

You’re not the only one wondering what VPNs are. VPNs gained popularity in Australia after the pandemic and in response to cybercrime spikes in COVID-19 shutdowns.

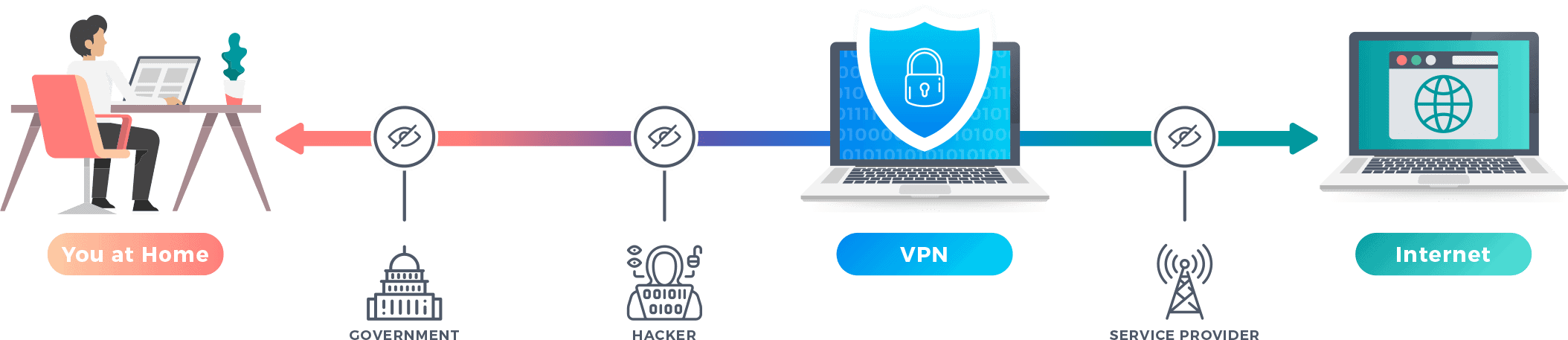

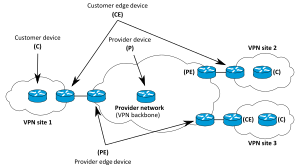

A VPN (also known as a Virtual Private Network, is a service that provides Internet users with an encrypted, secure Internet connection. VPNs work by using remote VPN servers that VPN users connect to in order to connect to the Internet and encrypted and, therefore, almost anonymous connection.

Virtually anonymous means that while VPNs can mask your IP (Internet Protocol) address by giving you a completely new IP address that belongs to the VPN server, malicious third parties can still track your use of that particular website or platform. VPN help.

In addition, if you use a VPN connection to log into personal accounts online, it can potentially reveal your identity and geographic location.

Cybersecurity experts see VPNs as a necessary foundation upon which users can build their own customized dynamic cybersecurity strategy. What other elements can you add to your strategy?

Stay on top of software updates

It’s cost-effective and easy to stay up-to-date on your devices and software. Simply put, software updates are generally developed by software developers to keep apps in top shape to provide the best user experience.

Software updates may also contain security patches. These patches help applications keep their security measures in place and protect them from malicious third-party activity. In fact, most of the common software updates that you might download are just to increase the security of this app.

With this in mind, users cannot allow apps installed on their devices to be delayed until software updates are available.

We recommend setting up automatic software updates and periodically reviewing the apps installed on your devices to get rid of old apps you no longer use.

Set social media accounts to private

While some social media platforms like Twitter and Instagram encourage users to maintain public profiles to increase their reach, there are some real dangers that come with being too open about your private life online.

Hackers can use public profiles to access all of your personal information. For example, simply posting birthday celebration photos can easily reveal your date of birth as well as your age to malicious users. Tagging or logging places can also tell hackers about your geographic location or the areas you’re likely to visit.

This information could be used to create phishing attacks to take advantage of your money, or any additional personal information that hackers could use to build a better picture of you as a user and as an individual. If malicious parties have access to enough information about you, you may be vulnerable to phishing and other cyber attacks.

You can greatly reduce your risk of becoming a victim of a variety of cybercrimes, including identity theft and digital fraud, by keeping your social media accounts secure or restricting access to your posts.

Only shop on trusted sites

Of course, keeping your social media profiles private is only one part of the equation when sharing personal information online. As we mentioned earlier, millions of people around the world shopped online during the COVID-19 pandemic.

In addition, hundreds of thousands of new e-commerce ventures started popping up online, with many Aussie consumers recognizing new digital businesses running ads on their social media feeds.

A website does not necessarily indicate that a store is trustworthy. There are many fake e-commerce sites that aim to look impressive, but they don’t actually deliver the goods. Shopping on these sites has resulted in consumers losing hundreds of thousands of dollars waiting for seemingly high-quality products that never show up.

There are methods to identify a fake e-commerce site, some of which include reading previous customer reviews and checking the site’s contact information and Google Transparency Report.

If a site has no customer reviews, you should consider it a red signal. You can also check reviews on the site and search for feedback on forums like Reddit.

Develop an eye for identifying scams

The best way to keep yourself safe online is to be aware of the warning signs to look for when dealing with suspicious content. Understanding what fraud looks like is essential to reducing the chance of becoming a victim.

Stay informed about the latest phishing attacks in your neighborhood, work, or school. Also, make sure you are trained to be aware of any potentially harmful or enticing content that is communicated to you.

Developing strong digital literacy skills is critical to staying safe online. This should be a priority, along with the implementation of solid cyber security measures. The best cybersecurity strategies are flexible and adaptable.

How do banks investigate unauthorized transactions?

The bank initiates a payment fraud investigation by receiving information about the transaction from the cardholder. They look at all relevant information, such as whether the transaction was made with or without a card. The bank also examines whether the fee is in line with the cardholder’s usual spending habits.

Can banks find out who used your credit card? Tips. Credit card companies can track when a stolen credit account was last used. But this is usually only possible if the card is used by the owner. The credit card authorization process helps banks monitor this. However, law enforcement may not arrive until the person has left.

Can banks refund Unauthorised transactions?

According to the Reserve Bank of India, customers will get a full refund even if they made an unauthorized transaction.

Are banks liable for unauthorized transactions?

Your liability for unauthorized charges is limited by federal law and bank policy. It is important to notify your bank or card issuer as soon as you notice any loss or theft.

How banks deal with unauthorized transactions?

If you dispute an unauthorized transaction, the bank has 10 days to investigate. If a merchant was involved in the transaction, it’s a good idea to contact them and dispute the purchase. However, if the bank does not, the seller may refund your purchase.

What happens when you report an unauthorized transaction?

If you dispute an unauthorized transaction, the bank has 10 days to investigate. If the transaction involved a retailer, it’s a good idea to contact them and dispute the purchase. If the bank does not offer a refund, the merchant may refund your purchase.

What can I do about unauthorized transactions?

Report any suspicious charges or debits immediately. If you suspect an unauthorized debit or payment, contact your bank immediately. You should immediately stop using your card and have it replaced if a thief takes items from your account.

What does Unauthorised transaction mean?

Unauthorized transactions are when money is withdrawn from your account without your permission. A fraudulent transaction occurs when you make payments to an unauthorized person or company using incorrect bank details.

How long do banks investigate unauthorized transactions?

Federal Trade Commission rules allow banks to respond within 30 days of receiving a cardholder’s request. Banks usually respond quickly to disputes with customers to provide better service.

How long does a bank have to investigate a dispute?

The card issuer must complete the investigation within two billing cycles of receiving the dispute. This generally means that it should not last more than 90 days.

How long does it take for a bank to refund stolen money?

Once you report the theft, it can take up to two weeks for banks to return the stolen money. The policy for quick replacement of stolen funds varies from bank to bank.

What information does someone need to access your bank account?

What is needed to open bank accounts

- A valid government-issued photo ID, such as a driver’s license or passport. …

- Other basic information, such as your date of birth or Social Security number, taxpayer identification number, or phone number.

- Some banks also require an initial deposit.

What details does the scammer need? Scammers can use your personal financial information to steal your identity online, at your door, or over the phone. They want account numbers, passwords, social security numbers, and other confidential information that they can use to steal your checking account or run credit card bills.

Can my bank account be hacked with my account number and name?

No one’s bank account can be compromised without the permission of an insider in the bank or without the knowledge of the account holder. Unknown links, submitting bank account details to unknown phone numbers and entering bank details on unsafe websites can put you at risk. This is not possible.

Can someone steal your money if they know your account number?

Although a bank’s routing number is not enough to access your checking accounts, someone can steal your money if they have both your account and routing numbers. Your debit card credentials can also be used to receive cash.

Can you get hacked from your account number?

Your account cannot be hacked with just the account number. In fact, checks contain this information and more about them and are safe to use. Making payments is part of our everyday life.

What information would someone need to access my bank account?

If they have access to your personal information such as your ID number, social security number, etc. They can identify you and access your bank account. If you are currently looking for work, it is a good idea to set up credit and fraud monitoring to ensure that no one uses your credentials for inappropriate purposes. motives.

Can someone steal your money with your bank account number?

While a bank routing number isn’t enough to gain access to your checking accounts, someone can steal your money if they have both your account and routing numbers. You can also steal money by using your debit card credentials.

What can a scammer do with my bank account number?

The fraudster may have access to your routing numbers and bank account details. They can transfer money from your account to bill you for services you don’t use. This information is not easy to protect because your routing number and account number are hidden at the bottom of your check.

Is it safe to give someone your bank account number?

It is generally safe to share your bank account number with anyone. There is always a risk in giving out a number, so only give it to people you trust completely. If you don’t trust the person asking for the number, try paying with cash instead of giving out the number.

Can a bank account be hacked with account number and name?

No bank account can be hacked without the bank’s insider knowledge or the inexperienced actions of the bank account holder. Unknown links, giving your bank account details to unknown callers and entering your bank details on insecure websites can put you at risk. This is not possible.

Is it safe for me to provide my bank account number and name? It is generally safe to have your bank account number to deposit money. An employer or family member may require this number to deposit money into your account. This can be dangerous if other sensitive information, such as your social security number, is available to other people.

Can someone get into your bank account with just your name?

A criminal can access your accounts and take out credit on your behalf using your Social Security number and your name. This is a crucial decision that you don’t have the money to make. The risks are too great. This involves writing it out to the IRS on a check.

Can someone else get money from my bank account?

A shared account allows everyone to make checks, withdraw money and make transactions. Similarly, if one of the account holders is in debt, the creditor can try to collect the debt from the money in the joint bank account.

What can someone do if they have your bank account details?

There’s not much anyone could do with your account number and type code other than make a deposit into your bank account to pay you. Be careful who you share your personal information with. Do not disclose your PIN to anyone.

Can someone steal your money if they know your account number?

A bank’s routing number is usually not enough to gain access to your checking account, but anyone can withdraw money from your account if they have your routing number and account number. Your debit card details can also be used to smuggle your cash.

What can someone do with your bank account number and routing number?

If a fraudster has access to your bank account and routing numbers, they can bill you for services you don’t use or withdraw money from your bank account. These details are difficult to protect because your routing number and account number are hidden at the bottom of your checks.

Is it safe to give someone bank account and routing number?

Conclusion. Giving someone your bank account number is usually safe. The number is not secure. Only give it to people you trust. You can also pay in cash instead of giving the number to someone you don’t know.

Do banks refund scammed money?

If you have paid by bank transfer, direct debit or wire transfer, call your bank immediately to inform them of the situation and request a refund. Most banks will reimburse you if you have transferred money to someone due to fraud.

Within what period does the bank or credit union have to pay back the stolen money? The credit union or bank must then resolve the issue within 45 days, unless the disputed transactions were made overseas, were made within 30 days of opening the account, or the point-of-sale transactions were made with debit cards. In these situations, the credit union or bank may be required to resolve the issue within 45 days.

How do I get my money back from a bank after being scammed?

Contact your bank or the company that issued your credit or debit card. Tell them it was a scam. To ensure a refund, ask them to reverse the transaction.

Are banks insured against hackers?

FDIC deposit insurance does not protect accounts from online theft or fraud. Other laws and practices may also provide protection against cyber theft.a

What can banks do to protect themselves from hackers? In addition to 2FA, some banks also offer secure security tokens that are encrypted. These small handheld devices generate one-time passcodes that you can use to log into your account. Because these are physical devices owned by your bank and kept safe by you, hackers have no access without physically handling them.

Are banks insured against cyber crime?

The key of the key. The Federal Deposit Insurance Corporation (FDIC) is a depositor insurance program sponsored by the federal government that protects bank depositors up to a maximum of $250,000. However, the FDIC cannot provide protection against identity theft or the resulting financial losses.

What is the difference between information assurance and information security?

Information security is all about data collection. Information security is about keeping data safe. In most companies, these two tasks are combined into one department or one person. To succeed in this field, you need to understand cyber security, database management, and security technology.

What is covered by cyber insurance?

Cyber insurance protects your business from liability in the event that sensitive customer information such as social security numbers or credit card numbers, account numbers and driver’s license numbers are compromised.

Do banks refund money if hacked?

What can I do to get my money back? Your bank should reimburse you for any money stolen from you through identity theft or fraud. They should do this as soon as possible, preferably by the end of the next business day after reporting the problem.

What if banks get hacked?

Impact of Cyber Attacks on Bank Customers Bank accounts up to $250,000 are insured by the Federal Deposit Insurance Corporation for participating institutions. However, the banks themselves do not have a formal solvency guarantee from the federal government in the event of a major cyber attack.

How long does it take for a bank to refund stolen money?

If you report the theft to the bank, it may take up to two weeks for the stolen money to be returned. The procedure for the quick return of stolen money varies from bank to bank.

Are bank accounts protected from hackers?

Most banks are well protected from hackers. This should not prevent you from using any financial institution. But should your hard-earned money be compromised, here’s how you can regain control of your account.

Am I protected if my bank account is hacked?

It’s rare that you’ll lose money if someone hacks you. Banks are equipped to do this, which means that removing money from your account is no easy task. Your account is (or should be) FDIC insured

Can bank accounts be hacked into?

Whether or not you use a brick-and-mortar institution like Chase or an online-only bank like Chime, your account can be compromised by hackers and fraudsters. CHICAGO (WLS) — Whether or not you choose to bank exclusively online or with a brick-and-mortar bank, your accounts could be at risk.

Can someone read my emails without me knowing?

If the email administrators haven’t posted your last login information elsewhere and you don’t know if the status of the messages is read/unread or if the messages change in mysterious ways. Google actually publishes the last few IP addresses that logged into the account. It’s at the bottom of the page.

Can another person read to us? (Source.) An unencrypted email transported in plain text between email providers can be read by anyone sitting between their servers. Especially by secret services who have access to exchange points.

Can someone have access to my email without me knowing?

Your email program or browser may save your password to make it easier. If you allow it to access your email, it’s as secure as your computer. Anyone with access to your computer can access your email. Nowadays, the easiest way to hack someone’s email is to use a phishing attack.

Can someone hack your email with just your email address?

Is it possible to hack your email with just your email address? Hackers can hack your email using various email hacking techniques if they have access to your email address. They may send you phishing emails or try to crack your password.

Can someone else access my emails?

It doesn’t matter if it’s a personal or business account, having your email compromised is a scary possibility. Hackers can easily access information you send, such as passwords, account numbers or bank details. They can also use your account to deliver malware and attack other computers.

Sources :