Can banks see your internet history?

Lenders may soon use data from your browsing, search and purchase history to create a more accurate credit score, analysts say. Most of that information is publicly accessible, while some may need to be provided to the credit bureaus. Taken together, that data forms your “digital footprint.”

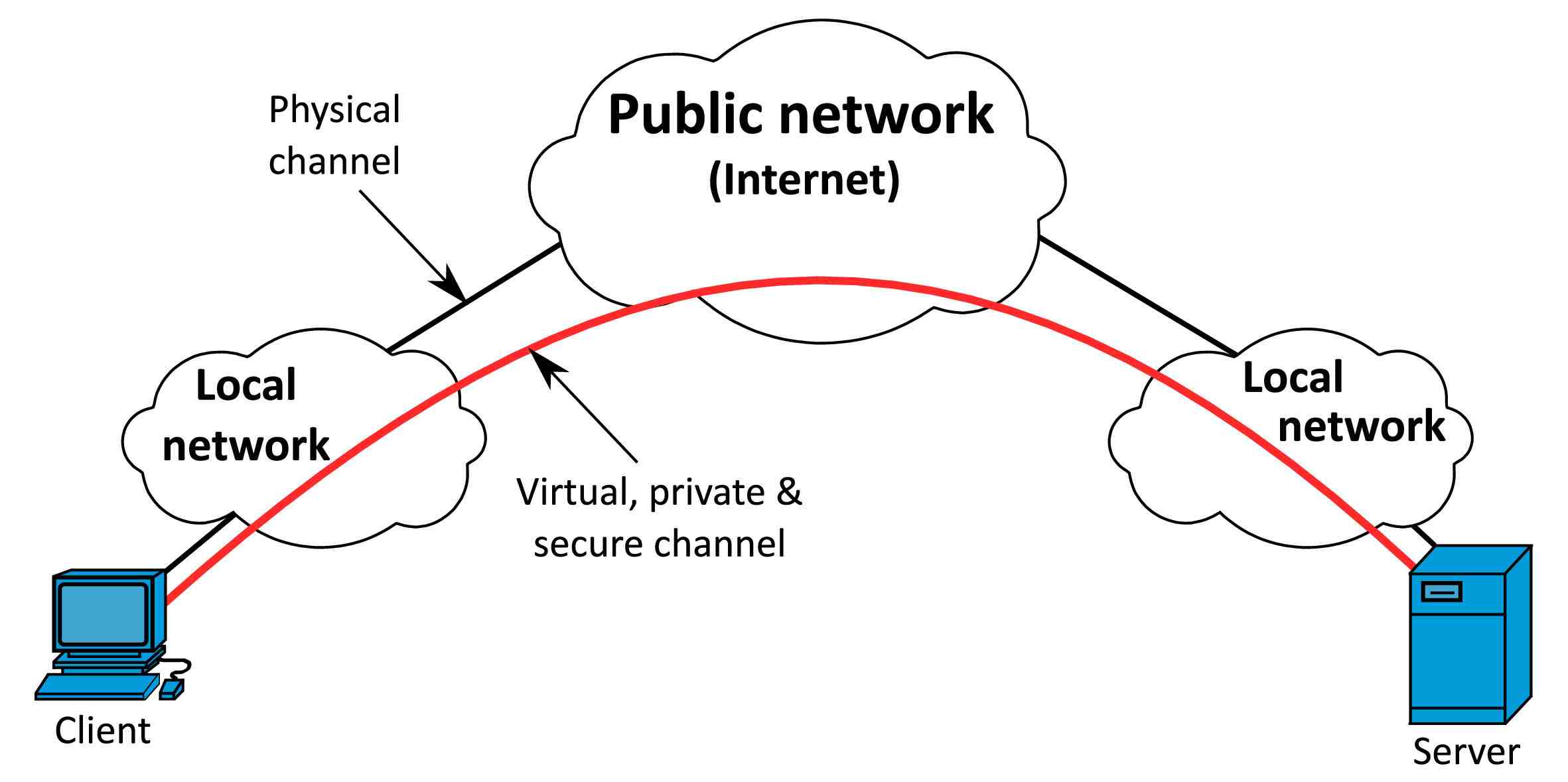

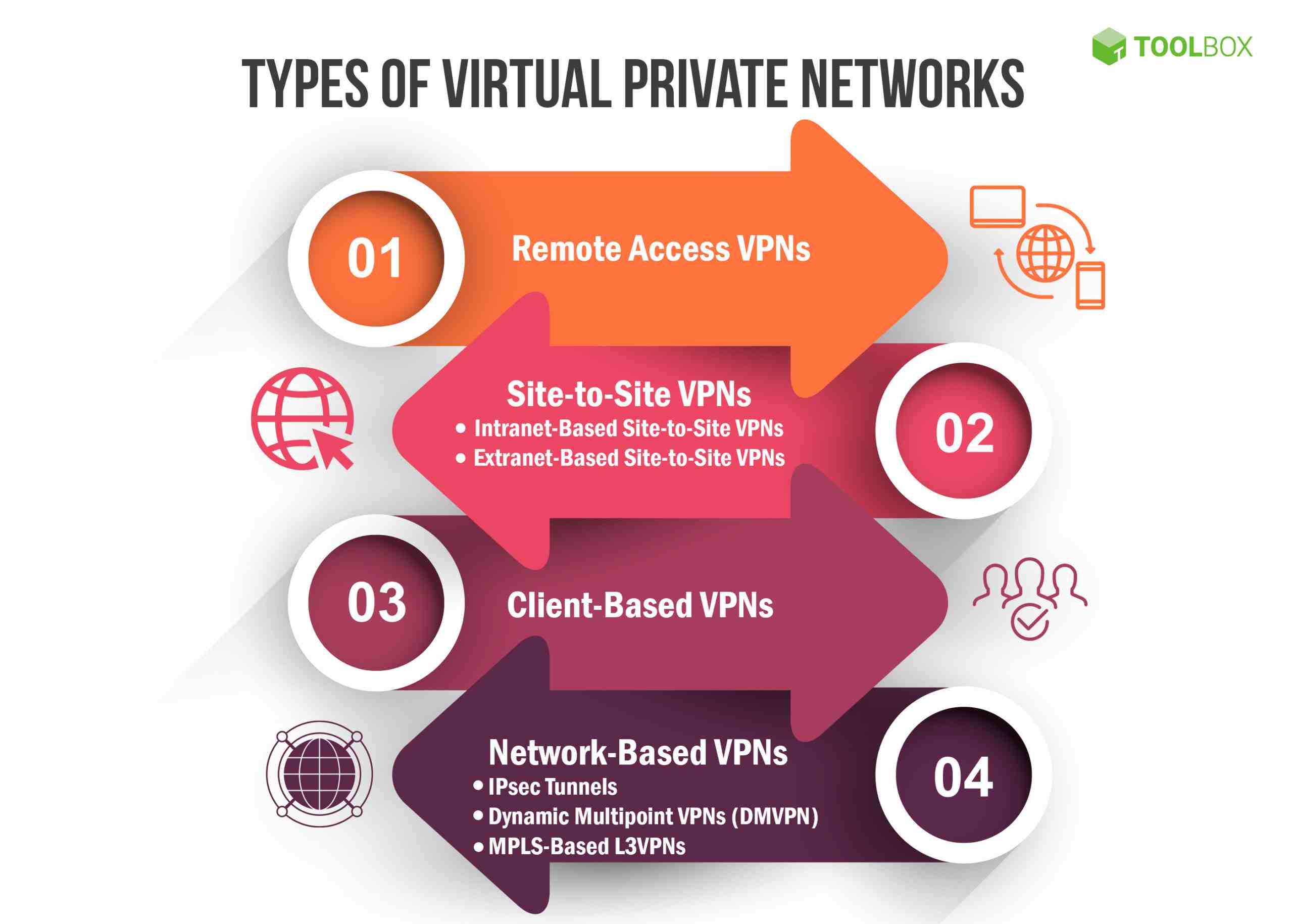

Where can internet history be tracked? The US government mandates that ISPs keep records of internet customer history for at least 90 days. If you don’t want your ISP (or the government or hackers) to monitor your internet history, invest in a secure private network (VPN).

Can anyone see what you search on the Internet?

No, only the surface. Your internet provider collects and stores this information for a period of time in accordance with data retention policies (usually 6 months/1 year). The best way to protect your data is to prevent them from seeing your search history at all. Use data encryption tools like Tor, VPN, or HTTPS proxy.

Who can see your Internet history?

Who can see your web activity?

- Wi-Fi network administrator. …

- Internet service providers (ISPs) …

- Operating systems. …

- Find the engine. …

- Websites. …

- Apps. …

- Government. …

- Hackers.

Why do banks block VPN?

Like most banks, Bank of America blocks VPN connections to stop fraudulent activity. You will need to connect through US servers to use the VPN with Bank of America. Is VPN safe for online banking? A VPN increases your online security and privacy.

Can I access my bank account with a VPN? Overall if you plan your trip and make sure to connect through your home country or your mobile phone when using a VPN service to access your bank accounts you shouldn’t have any major problems.

Why does VPN get blocked?

This error may be caused due to a temporary problem with your network connection. If you were able to connect to the VPN before on the same Wi-Fi network, wait a while and try to connect to the VPN again. Some Wi-Fi networks do not allow VPN connections and restrict VPN access using network or firewall settings.

Can debit card purchases be traced?

To make it harder for someone to trace your credit card number to your credit card account, an EMV chip embedded in the card generates a new number every time you use it to make a purchase. Since individual transaction numbers cannot be traced back to your card, it is not possible to trace debit card chips.

Can the bank trace who has used my debit card? You can be confident in knowing that anyone who can process a credit card charge must have a merchant account, which is linked to personally identifiable information about the account holder. Banks make it easy to find out who charged your debit card.

Can debit card purchases be tracked?

As of now, there is no way to track debit or credit cards. The smart chips will help protect your information, but they are not designed to access the card. That said, there are options like the Visa Mobile Location Confirmation app. These options come in exchange for leaving some secrets.

How do I track a debit card transaction?

There are several resources you can use to track credit card purchases. The first place you should look for help is “track my debit card” or “use a tracking app” from the bank that issued the card.

Can a bank see who used your card?

Ideas. Credit card companies can find out where your stolen credit card was last used, usually, if the card is used by the person who took it. The credit card approval process helps the bank comply with this. However, by the time the law arrives, the person may be long gone.

Can a bank seek a transaction? Bank representatives may request additional information if it appears to have been lost in the system, including the type of transaction. However in most cases, they will be able to pinpoint the transfer route and destination within the ACH network.

Can banks track debit cards?

As of now, there is no way to track debit or credit cards. The smart chips will help protect your information, but they are not designed to access the card. That said, there are options like the Visa Mobile Location Confirmation app. These options come in exchange for leaving some secrets.

How does the bank investigate an unauthorized payment?

How Do Banks Investigate Fraud? Bank investigators often start with transaction data and look for signs of fraud. Time stamps, location data, IP addresses, and other information can be used to identify whether a cardholder was involved in a transaction.

How can I find out who used my credit card?

Protect your credit accounts Always check that transactions recorded on credit card statements and online accounts were made by you or any authorized users. If you find it suspicious, contact your card issuer immediately to dispute the transaction.